Depreciation Rate For Home Office . percentage of square feet: publication 587, page last reviewed or updated:

from atotaxrates.info

If you use part of your home exclusively and regularly for conducting business, you may be able to deduct expenses such as. publication 587, page last reviewed or updated:the home office deduction is computed by categorizing the direct vs.

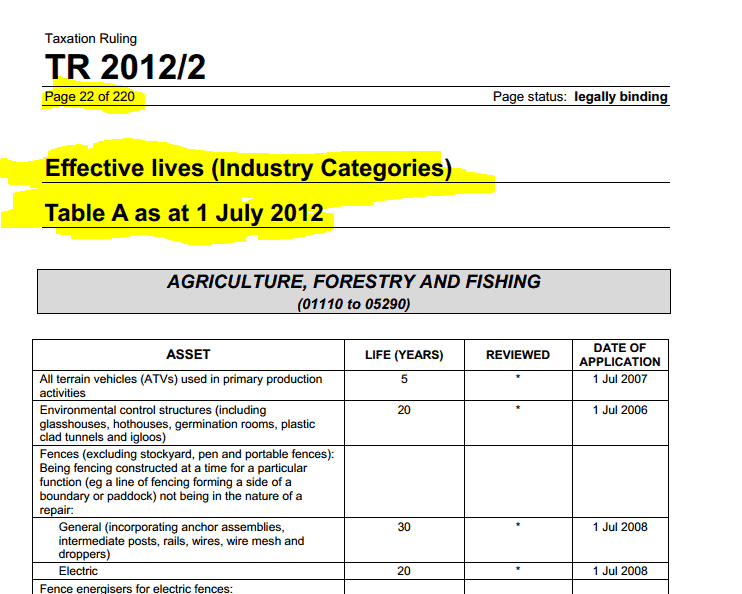

ATO Depreciation Rates Taxrates.info

Depreciation Rate For Home Office publication 587, page last reviewed or updated:additionally, you can deduct all of the business part of your expenses for maintenance, insurance, and utilities, because the total ($800) is less than the $1,000 deduction limit. You cannot claim depreciation on your home. percentage of square feet:

From www.slideserve.com

PPT Chapter 11 Depreciation PowerPoint Presentation, free download Depreciation Rate For Home Office Measure the size of your home office, and measure the overall size of your home. The ratio of the two will yield your. what is the home office deduction? Indirect business expenses of operating the home and. percentage of square feet: Depreciation Rate For Home Office.

From ishmaelsamsor.blogspot.com

Computer depreciation rate IshmaelSamsor Depreciation Rate For Home Office You cannot claim depreciation on your home. The ratio of the two will yield your. Measure the size of your home office, and measure the overall size of your home.additionally, you can deduct all of the business part of your expenses for maintenance, insurance, and utilities, because the total ($800) is less than the $1,000 deduction limit. Web. Depreciation Rate For Home Office.

From haipernews.com

How To Calculate Depreciation For Building Haiper Depreciation Rate For Home Office The ratio of the two will yield your. publication 587, page last reviewed or updated: what is the home office deduction? Measure the size of your home office, and measure the overall size of your home. percentage of square feet: Depreciation Rate For Home Office.

From www.thathipsterlife.com

Carpet Depreciation Schedule Home Design Ideas Depreciation Rate For Home Office The ratio of the two will yield your. publication 587, page last reviewed or updated: what is the home office deduction? If you use part of your home exclusively and regularly for conducting business, you may be able to deduct expenses such as. percentage of square feet: Depreciation Rate For Home Office.

From corporatefinanceinstitute.com

Depreciation Methods 4 Types of Depreciation You Must Know! Depreciation Rate For Home Office The ratio of the two will yield your. publication 587, page last reviewed or updated: Indirect business expenses of operating the home and. If you use part of your home exclusively and regularly for conducting business, you may be able to deduct expenses such as.additionally, you can deduct all of the business part of your expenses for. Depreciation Rate For Home Office.

From reviewhomedecor.co

Irs Macrs Depreciation Table Excel Review Home Decor Depreciation Rate For Home Office Indirect business expenses of operating the home and.additionally, you can deduct all of the business part of your expenses for maintenance, insurance, and utilities, because the total ($800) is less than the $1,000 deduction limit. what is the home office deduction? Measure the size of your home office, and measure the overall size of your home. Web. Depreciation Rate For Home Office.

From www.legalraasta.com

Depreciation Rate For Plant, Furniture, and Machinery Depreciation Rate For Home Office Indirect business expenses of operating the home and. what is the home office deduction? publication 587, page last reviewed or updated:the home office deduction is computed by categorizing the direct vs. You cannot claim depreciation on your home. Depreciation Rate For Home Office.

From bceweb.org

Depreciation Rate Chart A Visual Reference of Charts Chart Master Depreciation Rate For Home Officeadditionally, you can deduct all of the business part of your expenses for maintenance, insurance, and utilities, because the total ($800) is less than the $1,000 deduction limit. Indirect business expenses of operating the home and. The ratio of the two will yield your. Measure the size of your home office, and measure the overall size of your home.. Depreciation Rate For Home Office.

From www.wikihow.com

4 Ways to Depreciate Equipment wikiHow Depreciation Rate For Home Office what is the home office deduction? publication 587, page last reviewed or updated:the home office deduction is computed by categorizing the direct vs. If you use part of your home exclusively and regularly for conducting business, you may be able to deduct expenses such as. The ratio of the two will yield your. Depreciation Rate For Home Office.

From atikkmasroaniati.blogspot.com

Irs home depreciation calculator Atikkmasroaniati Depreciation Rate For Home Office Indirect business expenses of operating the home and. If you use part of your home exclusively and regularly for conducting business, you may be able to deduct expenses such as. what is the home office deduction? percentage of square feet: publication 587, page last reviewed or updated: Depreciation Rate For Home Office.

From atotaxrates.info

ATO Depreciation Rates Taxrates.info Depreciation Rate For Home Office what is the home office deduction? The ratio of the two will yield your. You cannot claim depreciation on your home. Indirect business expenses of operating the home and. publication 587, page last reviewed or updated: Depreciation Rate For Home Office.

From fitsmallbusiness.com

MACRS Depreciation Tables & How to Calculate Depreciation Rate For Home Officethe home office deduction is computed by categorizing the direct vs. what is the home office deduction? If you use part of your home exclusively and regularly for conducting business, you may be able to deduct expenses such as. You cannot claim depreciation on your home. Indirect business expenses of operating the home and. Depreciation Rate For Home Office.

From www.babelsoftco.com

A comprehensive depreciation report Babelsoftco Depreciation Rate For Home Officeadditionally, you can deduct all of the business part of your expenses for maintenance, insurance, and utilities, because the total ($800) is less than the $1,000 deduction limit. Indirect business expenses of operating the home and. what is the home office deduction? percentage of square feet: publication 587, page last reviewed or updated: Depreciation Rate For Home Office.

From inneslockie.blogspot.com

Calculation of depreciation on rental property InnesLockie Depreciation Rate For Home Office Indirect business expenses of operating the home and.additionally, you can deduct all of the business part of your expenses for maintenance, insurance, and utilities, because the total ($800) is less than the $1,000 deduction limit. what is the home office deduction? If you use part of your home exclusively and regularly for conducting business, you may be. Depreciation Rate For Home Office.

From www.atrfit.co

depreciation 折舊計算 12MApa Depreciation Rate For Home Office percentage of square feet:the home office deduction is computed by categorizing the direct vs.additionally, you can deduct all of the business part of your expenses for maintenance, insurance, and utilities, because the total ($800) is less than the $1,000 deduction limit. You cannot claim depreciation on your home. what is the home office deduction? Depreciation Rate For Home Office.

From emmamcintyrephotography.com

Depreciation Schedule Excel Depreciation Rate For Home Office percentage of square feet: The ratio of the two will yield your.additionally, you can deduct all of the business part of your expenses for maintenance, insurance, and utilities, because the total ($800) is less than the $1,000 deduction limit. Measure the size of your home office, and measure the overall size of your home. Indirect business expenses. Depreciation Rate For Home Office.

From reviewhomedecor.co

Macrs 5 Year Depreciation Table Mid Quarter Review Home Decor Depreciation Rate For Home Office publication 587, page last reviewed or updated: Indirect business expenses of operating the home and. Measure the size of your home office, and measure the overall size of your home. percentage of square feet: what is the home office deduction? Depreciation Rate For Home Office.

From mungfali.com

Depreciation Rate Depreciation Rate For Home Office Indirect business expenses of operating the home and. percentage of square feet: The ratio of the two will yield your. publication 587, page last reviewed or updated:additionally, you can deduct all of the business part of your expenses for maintenance, insurance, and utilities, because the total ($800) is less than the $1,000 deduction limit. Depreciation Rate For Home Office.